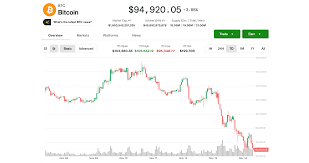

Crypto Market Crash Today: Bitcoin Drops Below $88,000 — Ethereum, XRP Also Decline (Dec 1, 2025)

Bitcoin Drop Ends Up Liquidating $500M Bullish Bets in Early Asia Trading

Binance, Hyperliquid, and Bybit saw over $160 million in liquidations each, with longs making up almost 90% of the total.

The crypto market turned red today as Bitcoin slipped below $88,000 amid global risk-off sentiment. Ethereum, XRP, and major altcoins also fell sharply. Read the full market analysis and what comes next.

Crypto markets were hit with a fresh wave of forced liquidations early Monday as nearly $646 million in leveraged positions were wiped out across major exchanges, adding to the month’s bruising close and extending losses in bitcoin, ether and large-cap altcoins.

Coinglass data shows longs made up almost 90% of the total, with the largest single liquidation a $14.48 million ETH-USDC order on Binance.

Binance, Hyperliquid and Bybit each recorded more than $160 million in liquidations, reflecting heavy positioning that snapped during the Asian session.

Liquidation refers to when an exchange forcefully closes a trader’s leveraged position due to a partial or total loss of the trader’s initial margin. It happens when a trader is unable to meet the margin requirements for a leveraged position (fails to have sufficient funds to keep the trade open).

crypto news today

A cascade of liquidations often indicates market extremes, where a price reversal could be imminent as market sentiment overshoots in one direction.

Bitcoin fell more than 5% to around $86,000 while ether slid over 6% to near $2,815. Both tokens had attempted a mild rebound late last week, but the forced unwinds dragged prices back toward the lower end of November’s range.

Solana, XRP, BNB and Dogecoin dropped between 4% and 7% in the same period, while Cardano and Lido Staked Ether posted deeper losses. Traders pointed to thin liquidity and ongoing macro uncertainty as contributors to the speed of the move.

The market has been struggling to stabilize after a rapid drawdown through late November, when macro signals, ETF outflows and weak weekend volumes combined to unwind weeks of crowded positioning.

Monday’s purge followed the same pattern seen during earlier selloffs this year: heavy long exposure builds into resistance, funding shifts, and a cascade of forced selling pushes major assets lower within hours.

Open interest across BTC and ETH perpetuals slipped further after the rout, suggesting some of the leverage that built up during the October rally continues to wash out.

Traders say positioning now looks cleaner, but with risk appetite still fragile, intraday swings are likely to remain elevated until liquidity improves during the U.S. session.

bitcoin price crash

crypto market update

ethereum price analysis

crypto crash December 2025

crypto news, bitcoin today, ethereum analysis, crypto crash, blockchain news, btc price, eth price, altcoin market

#CryptoNews #Bitcoin #Ethereum #CryptoMarket #BTC #ETH #XRP #CryptoUpdate #Blockchain

🔥 Today’s Top Crypto Highlights (Dec 1, 2025)

Bitcoin (BTC) dropped below $88,000, falling around 6% in the last 24 hours as global risk sentiment weakened.

Ethereum (ETH), XRP, and other top altcoins also saw significant sell-offs.

Market volatility increased after global economic uncertainty and weak institutional demand.

Hong Kong stablecoin-related stocks plunged after a new PBOC crackdown announcement.

South Korea’s largest crypto exchange Upbit reported a $30M theft, adding more pressure to the market.

📉 Why Is the Crypto Market Falling Today?

1. Global Risk-Off Sentiment

Investor confidence dropped across global markets, pushing funds away from riskier assets like crypto. This triggered a wave of panic selling.

2. Weak ETF Demand & Bearish Charts for Bitcoin

Bitcoin analysts reported:

lower ETF inflows,

bearish technical patterns,

and decreased institutional activity —

all contributing to BTC’s downturn in early December.

3. Government Crackdowns Affecting Sentiment

China’s central bank (PBOC) announced tougher measures against stablecoins.

Hong Kong’s crypto-related stocks immediately fell, spreading fear into the overall market.

4. Upbit $30 Million Hack

The largest South Korean crypto exchange, Upbit, revealed a major hack of approx. $30M.

This news increased fear, uncertainty, and doubt (FUD) across the Asian market.

💡 Analyst Outlook for December 2025

Experts suggest two possible scenarios:

Bullish Scenario

If global market conditions stabilize,

Bitcoin may see a rebound rally above $90,000,

and Ethereum could recover above its weekly resistance.

Bearish Scenario

If risk sentiment stays weak,

Bitcoin may retest lower support zones,

and altcoins could continue deeper correction.

For now, investors are advised to maintain caution, track volatility, and avoid heavy leverage.